UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Reliv International, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

RELIV’ INTERNATIONAL, INC.

136 Chesterfield Industrial Boulevard

Chesterfield, Missouri 63005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO

BE HELD ON MAY 23, 201326, 2016

| To: | Stockholders of Reliv’ International, Inc. |

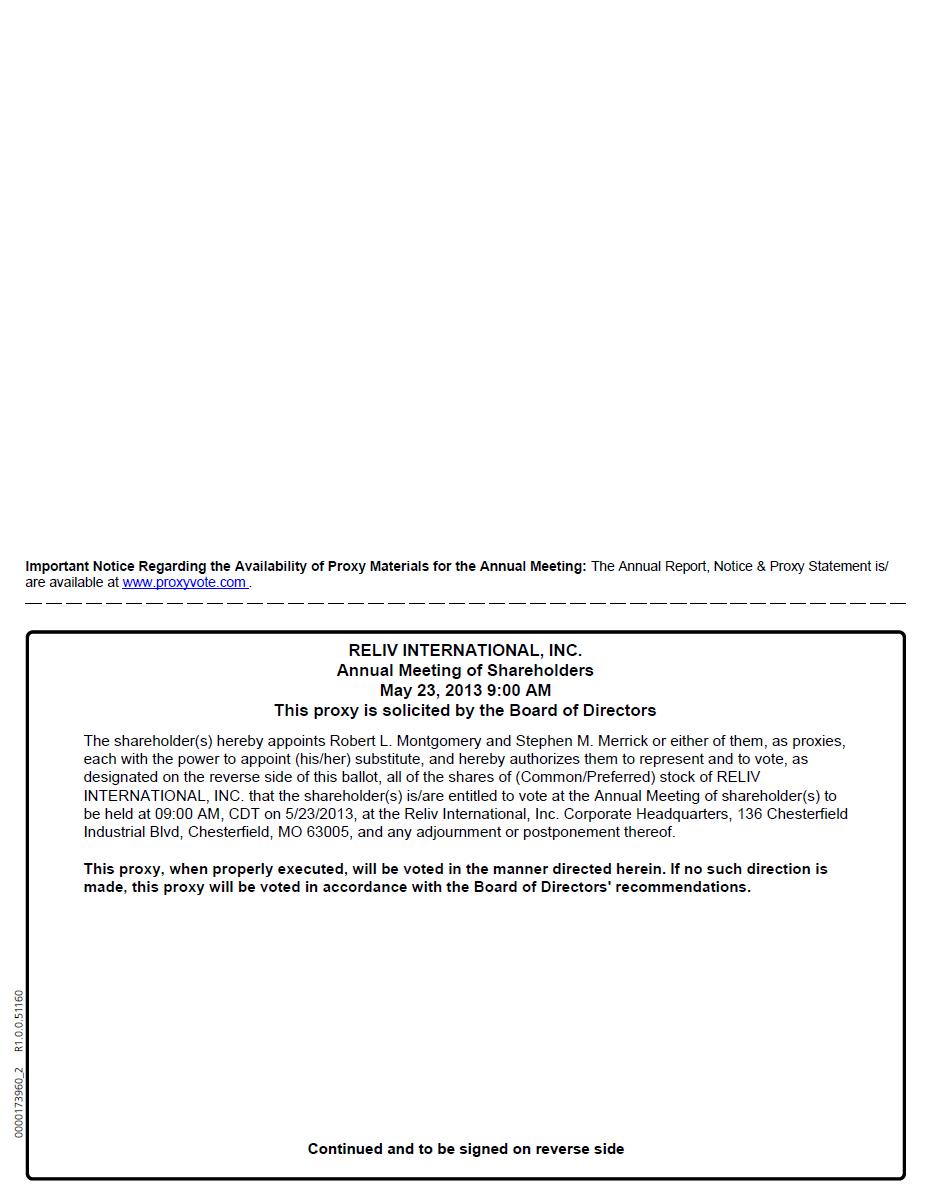

The Annual Meeting of the Stockholders of Reliv’ International, Inc. will be held at Reliv’ International, Inc., Corporate Headquarters, 136 Chesterfield Industrial Boulevard, Chesterfield, Missouri 63005, on Thursday, May 23, 2013,26, 2016, at 9:00 a.m., Central Daylight Savings Time, for the following purposes:

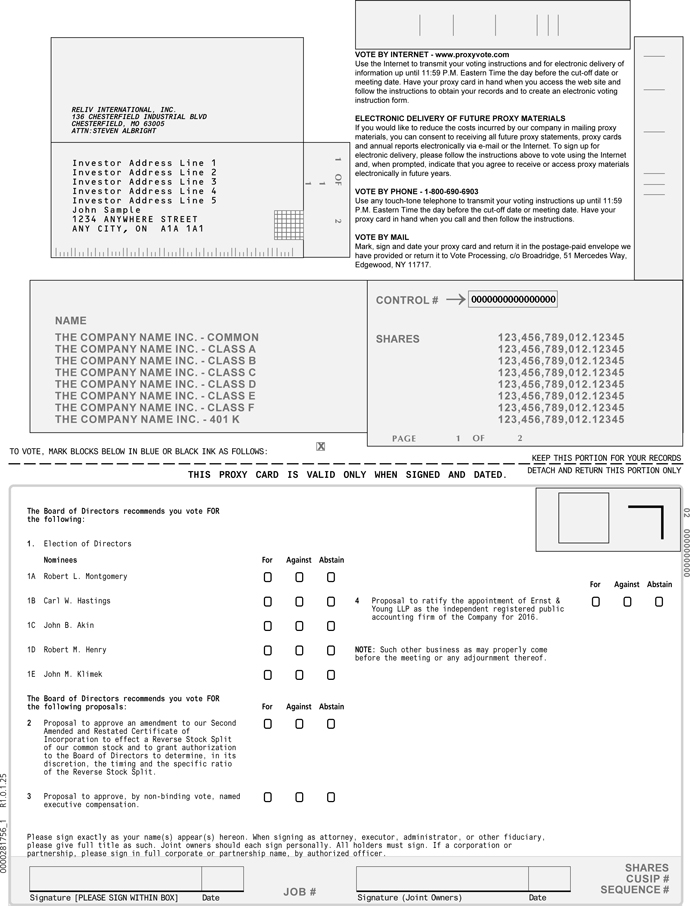

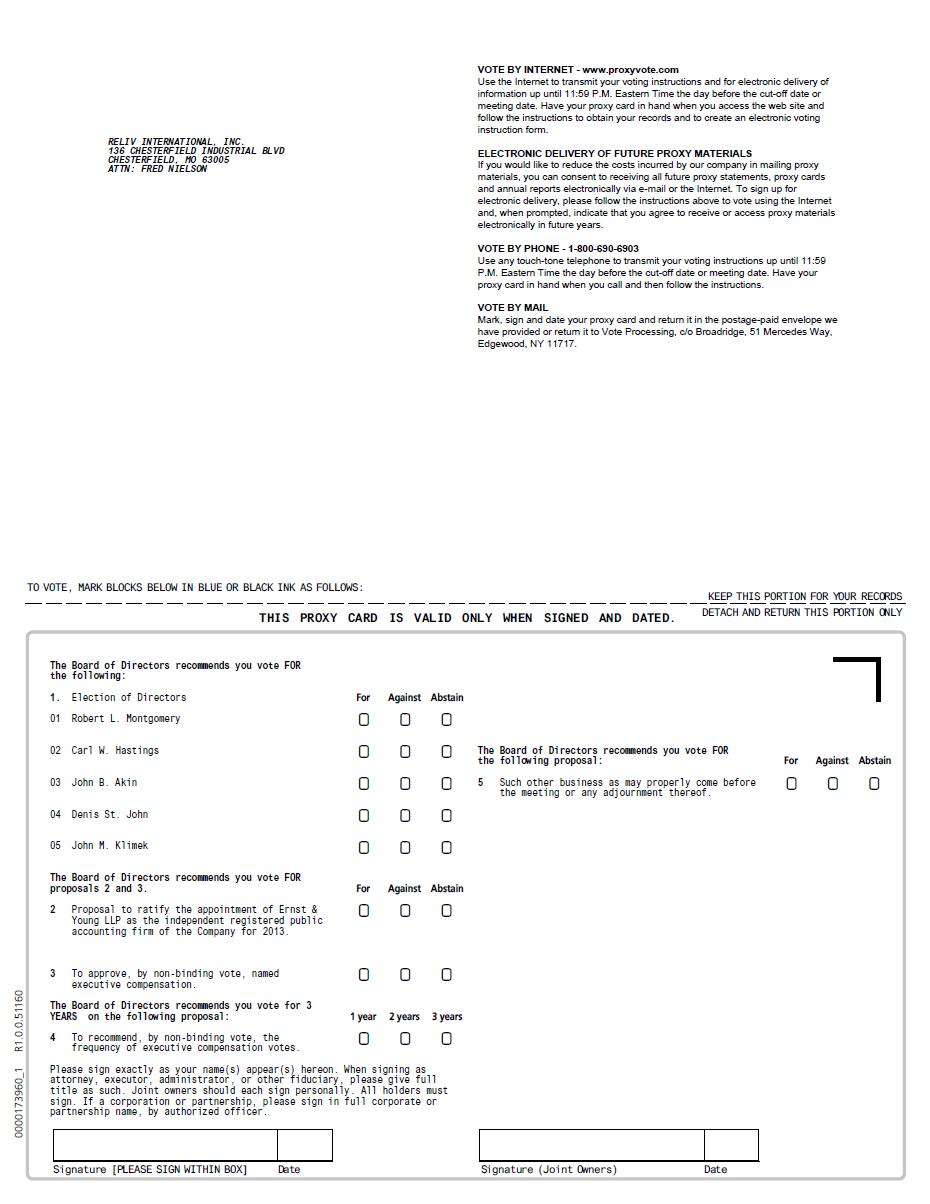

| 1. | To elect 5 directors to hold office during the year following the Annual Meeting or until their successors are elected (Item No. 1 on the proxy card); |

| 2. | To |

| 3. | To approve, by non-binding vote, named executive compensation (Item No. 3 on proxy card); and |

| 4. | To |

| 5. | To transact such other business as may properly come before the meeting. |

The close of business on March 22, 2013,24, 2016 has been fixed as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

April 8, 20132016

/s/ Stephen M. Merrick________________

Stephen M. Merrick, Secretary

| /s/ Stephen M. Merrick | |

| Stephen M. Merrick, Secretary |

YOUR VOTE IS IMPORTANT

It is important that as many shares as possible be represented at the Annual Meeting. Please read this Proxy Statement and submit your Proxy via the Internet, or if you received a paper copy of your proxy materials, by using the toll-free telephone number provided or by completing, signing, dating and returning your Proxy in the pre-addressed envelope provided. Your Proxy may be revoked by you at any time before it has been voted.

RELIV’ INTERNATIONAL, INC.

136 Chesterfield Industrial Boulevard

Chesterfield, Missouri 63005

PROXY STATEMENT

Information Concerning the Solicitation

The Board of Directors of Reliv’ International, Inc. (the “Company”) is furnishing this Proxy Statement for the solicitation of proxies from holders of the outstanding common stock of the Company to be used at the 20132016 annual stockholders meeting (the “Annual Meeting”) of the Company which will be held on Thursday, May 23, 201326, 2016 at 9:00 a.m., Central Daylight Savings Time. The Company has elected to provide access to these proxy materials over the Internet in accordance with rules adopted by the Securities and Exchange Commission.Commission (the “SEC”). On April 8, 20132016 we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record and beneficial owners. The Notice instructs you on how you may access the proxy materials on the Internet. It also instructs you on how you may vote your proxy. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting printed materials included in the Notice.

The cost of preparing, assembling and furnishing the proxy material and of reimbursing brokers, nominees and fiduciaries for the out-of-pocket and clerical expenses of transmitting copies of the proxy material to the beneficial owners of shares held of record by such persons will be borne by the Company. The Company does not intend to solicit proxies otherwise than pursuant to the Notice and, where requested, mailing of proxy materials, but certain officers and regular employees of the Company or its subsidiaries, without additional compensation, may use their personal efforts, by telephone or otherwise, to obtain proxies.

Your vote is very important. Whether or not you plan to attend our Annual Meeting, please take the time to vote either by the Internet or, if you requested a paper copy of the proxy materials, by telephone using the instructions on the proxy card or by completing and mailing the proxy card enclosed with the proxy materials as soon as possible. If you elect to vote using the proxy card in the proxy materials you requested be mailed to you, you must sign, date and mail it and indicate how you want to vote. If you do not so indicate, your proxy will be voted as recommended by the Board of Directors.

Quorum and Voting

Only stockholders of record at the close of business on March 22, 201324, 2016 are entitled to vote at the Annual Meeting. On that day, there were 12,619,64012,922,535 shares of common stock outstanding. Each share has one vote. Stockholders do not have cumulative voting rights in the election of directors. A simple majority of the outstanding shares is required to be present in person or by proxy at the meeting for there to be a quorum for purposes of proceeding with the Annual Meeting. A simple majority of the shares present in person or by proxy at the Annual Meeting, at which a quorum is present, is required to elect directors and approve the appointment of the Company’s independent registered public accounting firm. A simple majority of the issued and outstanding shares entitled to vote is necessary to approve the amendment to the Second Amended and Restated Certificate of Incorporation to effect the reverse stock split. Abstentions and withheld votes have the effect of votes against these matters. Broker non-votes (shares held of record by a broker for which a proxy is not given) will be counted for purposes of determining shares outstanding for purposes of a quorum, but will not be counted as present for purposes of determining the vote on any matter considered at the meeting.

If a stockholder specifies how the proxy is to be voted with respect to any of the proposals for which a choice is provided, the proxy will be voted in accordance with such specifications. If a stockholder fails to so specify with respect to such proposals, the proxy will be voted “FOR” the nominees for directors contained in these proxy materials, “FOR” the amendment to our Second Amended and Restated Certificate of Incorporation to effect a Reverse Stock Split of our common stock, “FOR” approval of the named executive compensation, and “FOR” the appointment of the Company’s independent registered public accounting firm, “FOR” approval of the compensation of the Company’s named executive officers as described in this proxy statement, and “FOR” the proposal providing for an advisory vote to be held every three years to approve the compensation of the Company’s named executive officers.firm. A stockholder submitting a proxy prior to the Annual Meeting has the power to revoke it at any time before the shares subject to it are voted by (i) sending a written statement to that effect to the Secretary of the Company, (ii) submitting a valid proxy having a later date, or (iii) voting in person at the Annual Meeting.

Discretionary Voting Power

The Board of Directors knows of no other matters to be presented for stockholder action at the Annual Meeting. On matters which may be raised at the Annual Meeting that are not covered by this Proxy Statement, the persons named in the proxy will have full discretionary authority to vote. If any nominee for election as a director becomes unable to accept nomination or election, which we do not anticipate, the persons named in the proxy may vote for the election of another person recommended by the Board of Directors.

BENEFICIAL OWNERSHIP OF SHARES BY MANAGEMENT AND

SIGNIFICANT STOCKHOLDERS

The following table provides information concerning the beneficial ownership of the Company’s common stock by each director and nominee for director, certainnamed executive officers, all of the Company’s directors and officers as a group, and the beneficial owners known to the Company to hold more than five percent of the Company’s outstanding common stock as of March 22, 2013.24, 2016.

The amounts and percentage of common stock beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission (“SEC”)SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days after March 22, 2013.24, 2016. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed a beneficial owner of securities as to which he has no economic interest. Percentage of class is based on 12,619,64012,922,535 shares of common stock outstanding as of March 22, 2013.24, 2016.

Name of beneficial owner(1) | Amount and nature of beneficial ownership |

Percent of class | Amount and nature of beneficial ownership | Percent of class | ||||||||

| Robert L. Montgomery(2) | 3,667,265 | 28.65% | 3,645,720 | 28.04 | % | |||||||

| Carl W. Hastings(3) | 671,318 | 5.30% | 647,843 | 5.00 | % | |||||||

| Stephen M. Merrick(4) | 499,561 | 3.94% | 463,221 | 3.58 | % | |||||||

| John B. Akin(5) | 11,750 | * | 3,250 | * | ||||||||

| Denis St. John(6) | 34,709 | * | ||||||||||

| John M. Klimek(6) | 2,000 | * | ||||||||||

| John M. Klimek(7) | 500 | * | ||||||||||

| Robert M. Henry | 1,000 | * | ||||||||||

| R. Scott Montgomery(8) | 140,381 | 1.11% | ||||||||||

| David T. Thibodeau | — | * | ||||||||||

| All Directors, nominees and Executive Officers as a Group (7 persons)(9) |

5,025,484 |

38.72% | ||||||||||

| Donald E. Gibbons, Jr. (7) | 41,530 | * | ||||||||||

| All Directors and nominees as a Group (8 persons)(8) | 4,804,564 | 36. 74% | ||||||||||

(footnotes on following page) | ||||||||||||

______________________

*less than one percent

| (1) | Unless otherwise indicated below, the person named in the table has sole voting and investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Unless otherwise indicated, the address for each person is c/o Reliv’ International, Inc., 136 Chesterfield Industrial Boulevard, Chesterfield, Missouri 63005. |

| (2) | Includes |

| (3) | Includes |

| (4) | Includes |

| (5) | Includes |

| (6) | Includes |

| (7) | Includes |

| (8) | Includes |

PROPOSAL ONE - ELECTION OF DIRECTORS

Five directors will be elected at the Annual Meeting to serve for terms of one year expiring on the date of the Annual Meeting in 2014.2016. Each director elected will continue in office until a successor has been elected. If a nominee is unable to serve, which the Board of Directors has no reason to expect, the persons named in the proxy intend to vote for the balance of those named and, if they deem it advisable, for a substitute nominee.

THE BOARD OF DIRECTORS RECOMMENDS THE ELECTION OF ALL OF THE NOMINEES.

Information Concerning Nominees

The following is information concerning nominees for election to the Board of Directors. Each of the following nominees is presently a member of the Board of Directors.

Robert L. Montgomery, age 71,74,is the Chairman of the Board and Chief Executive Officer. Mr. Montgomery became Chairman of the Board of Directors and Chief Executive Officer on February 15, 1985. Mr. Montgomery served as President of the Company from July 1985 until July 2012. Mr. Montgomery is the President and a director of Reliv’, Inc. and President and a director of Reliv’ World Corporation, both wholly owned subsidiaries of the Company. Mr. Montgomery has been the principal executive officer of the Company since its founding in 1985. Prior to that time, he held positions for a number of years as an executive officer of several life insurance companies. Mr. Montgomery received a B.A. degree in Economics from the University of Missouri in Kansas City, Missouri in 1965. Mr. Montgomery is the father of R. Scott Montgomery, the Company’s President of Reliv Asia Pacific, and Ryan A. Montgomery, the Company’s President.

Carl W. Hastings, age 71,74, was appointed Vice Chairman and Chief Scientific Officer in April 2007. Prior to his appointment in April 2007, he served as Vice President of the Company since July 1, 1992. Dr. Hastings has been employed by the Company since April 1991. Dr. Hastings has served on the Board of Directors from February 1990 to May 2004 and from May 2005 to the present. Dr. Hastings has been the principal food scientist for the Company for more than 20 years and has been primarily responsible for the development of a majority of the Company’s products. Dr. Hastings holds B.S. and M.S. degrees and a Ph.D. degree in Food Science from the University of Illinois. For more than the past 30 years, Dr. Hastings has been engaged in a variety of employment and consulting capacities as a food scientist. Dr. Hastings is the father of Steven G. Hastings, the Company’s SeniorExecutive Vice President, North American Sales and Marketing and Brett M. Hastings, Senior Vice President - Legal.and Chief Operating Officer.

| 3 |

John B. Akin, age 84,87,has been a member of the Board of Directors since June 1986. Mr. Akin retired as Vice President, A.G. Edwards & Sons and resident manager of the Decatur, Illinois branch office in 1995. Mr. Akin had been associated with A.G. Edwards & Sons as a stock broker, manager and officer since April 1973. Mr. Akin holds a B.A. degree from the University of Northern Iowa, Cedar Falls, Iowa, with a major in Social Science and minor in economicsEconomics and English literature.

Denis St. John, age 69,has been a member of the Board of Directors since May 2004. Mr. St. John is the chairman of Real Estate Development Strategies, LLC. and has held such position since May 2007. Until his retirement on October 31, 2007, Mr. St. John was a principal with Clifton Larson Allen, a regional public accounting firm, in the Health Care Group. For 42 years, Mr. St. John was associated with various accounting firms working primarily in the financing and tax area, serving mid-size, closely held companies. He has servedAkin serves on the boards of several non-profitCompensation and closely-held companies in the banking and manufacturing industries. Mr. St. John graduated from the University of Missouri with a Bachelor of Science in Business Administration with a major in Accounting. Mr. St. John is Certified Public Accountant and a member of the Missouri Society of CPAs and the American Institute of CPAs.Nominating Committees.

John M. Klimek,age 54,57, has been a member of the Board of Directors since May 2010. From August 2004 to the present, Mr. Klimek has been employed by HFR Asset Management, LLC, Chicago, Illinois, a hedge fund management company, and currently serves as Managing Director, Legal and Chief Compliance Officer. From December 1999 to August 2004, Mr. Klimek was a principal in the law firm of Merrick & Klimek, LLP, Chicago, Illinois.President. Mr. Klimek has been a practicing attorney in Illinois since 1984 specializing in corporate and securities law. He holds a B.S. in Accountancy from the University of Illinois and Juris Doctor Degree from the University of Illinois School Of Law. Mr. Klimek serves as the Chairman of the Compensation Committee and is a member of the Audit and Nominating Committees. He is also a director of CTI Industries Corporation (NASDAQ – CTIB).

Robert M. Henry, age 69, has been a member of the Board of Directors of the Company since November 2013. He was previously a member of the Board of Directors of the Company from May 2004 through May 2011. Mr. Henry is currently a private investor and business consultant. From January 2011 until May 2013, Mr. Henry served as Chief Executive Officer and Chairman of the Board for Immunotec, Inc., a public Canadian network marketing company that sells nutritional supplements(TSX Venture Exchange – IMM). From December 2004 to 2008, Mr. Henry served as Chairman and Chief Executive Officer of Arbonne International, Inc., a personal care products company. Mr. Henry received a B.S. degree in Accounting from Hunter College in New York and a J.D. from Brooklyn Law School. Mr. Henry serves as Chairman of the Audit Committee and a member of the Compensation and Nominating Committees.

Executive Officers Other Than Nominees

Ryan A. Montgomery, age 39,42,was appointed President onin July 24, 2012. Previously he was Executive Vice President, Worldwide Sales from April 2007 to July 2012 and Vice President, Sales from 2004 to 2007. Mr. Montgomery served as corporate counselCorporate Counsel from September 1999 to October 2004. Mr. Montgomery received his B.A. degree in Economics from Vanderbilt University in 1995 and graduated from Saint Louis University Law School in 1999.School.

R. Scott Montgomery, age 43,46,was appointed President of Reliv Asia Pacific onin July 24, 2012. Mr. Montgomery joined the Company in 1993 and previously served as Executive Vice President and Chief Operating Officer from April 2007 to July 2012, Senior Vice President – Worldwide Operations from 2004 to 2007 and Vice President of International Operations from 2001 to 2004. Mr. Montgomery graduated from Southwest Missouri State University with a B.S. degree in Finance and Investments.

Steven G. Hastings, age 50,was appointed Executive Vice President, Sales and Marketing in June 2013. He served as Senior Vice President, North American Sales from 2007 to 2013, Vice President, Sales from 2004 to 2007, Vice President of International Marketing from 2002 to 2004, and Director of International Marketing from 1996 to 2002. Mr. Hastings started with the Company in January 1993 as Director of Marketing. Mr. Hastings graduated from the University of Illinois with a Marketing degree and obtained his Master’s in Business from Butler University in Indianapolis.

Stephen M. Merrick, age 71,74, has been the Senior Vice President, Secretary and General Counsel since July 20, 1989 and served as a member of the Board of Directors from 1989 to May 2013.2013 and from May 2014 to May 2016. Mr. Merrick is Of Counsel to Vanasco, Genelly & Miller, which has served as legal counsel to the Company with respect tofor certain matters. Mr. Merrick is a principal of the law firm of Merrick & Associates, P.C., which has served as counsel to the Company with respect to certain matters. Mr. Merrickmatters, has been engaged in the practice of law for more than 45 years and has represented the Company since the Company’s founding. Mr. Merrick received a Juris Doctor degree from Northwestern University School of Law in 1966. He is also an officer and director of CTI Industries Corporation (NASDAQ:(NASDAQ – CTIB).

| 4 |

Donald E. Gibbons, Jr., age 60, was named Senior Vice President, U.S. Sales on September 16, 2014. Mr. Gibbons has been employed by the Company in various sales and administrative capacities since June 1991. Mr. Gibbons has served previously as Vice President of U.S. Sales and Senior Vice President of Worldwide Sales. Mr. Gibbons received a B.A. degree in Accountancy from the University of Illinois, Springfield.

Steven D. Albright, age 51,54,has been Senior Vice President and Chief Financial Officer since March 2005. Mr. Albright was the Vice President, Finance/Controller from 2002 to 2005 and was the Controller since 1992. Prior to his employment with the Company, Mr. Albright was employed from 1987 to 1992 as Assistant Controller for Kangaroos USA, Inc., an athletic shoe importer and distributor. For the period from 1983 to 1987, he was employed by the public accounting firm of Ernst & Young LLP. Mr. Albright received a B.S. degree in Accountancy from the University of Illinois at Urbana-Champaign in May 1983 and is a CPA.

Steven G. Hastings, age 47,was appointed Senior Vice President, North American Sales in April 2007. He served as Vice President, Sales from 2004 to 2007. Mr. Hastings was the Vice President of International Marketing from 2002 to 2004 and the Director of International Marketing from 1996 to 2002. Mr. Hastings started with the Company in January 1993 as Director of Marketing. Mr. Hastings graduated from the University of Illinois in 1987 with a Marketing degree and obtained his Masters in Business from Butler University in Indianapolis in 1995.

Kurt C. Wulff, age 48, was appointed Vice President, Marketing in 2005 and has been employed by the Company in marketing positions since 1999. Previously, Mr. Wulff had over 10 years of sales and marketing positions in a variety of industries. He graduated in 1986 from the University of Missouri-Columbia with a B.S. degree in Journalism.

Brett M. Hastings, age 39,42, was appointed Senior Vice President Legaland Chief Operating Officer in August 2007.June 2013. He has been employed by the Company since February 2005 and previously served as Vice President, Legal and as Associate General Counsel. Prior to his employment by the Company, Mr. Hastings was employed as a senior associate with the law firm of Doster Ullom, LLC from 2003 to 2005 and as an associate with Thompson Coburn, LLP from 1998 to 2003. Mr. Hastings graduated from Ohio Northern University in 1995 with a B.S.B.A and received a Juris Doctor degree from the University of Illinois School of Law in 1998.Law.

Ronald W. McCain,Kurt C. Wulff, age 47,51, was namedappointed Vice President, Sales DevelopmentMarketing in August 2007. He2005 and has been employed by the Company in variousmarketing positions since 1999. Previously, Mr. Wulff had over 10 years of sales and marketing and customer service capacities since 1996.

Joseph J. Wojcik, age 49, was appointed as Vice President, International on September 1, 2008. Prior to his employment with the Company, he waspositions in a principal and foundervariety of Endurance Business Solutions, a professional consulting firm advising companies on strategic entry into foreign markets, and, for a period of 11 years, was employed in various executive management positions at Herbalife International. Mr. Wojcikindustries. He graduated from Rutgersthe University of Missouri-Columbia with a Bachelor’sB.S. degree in Engineering in 1985 and from California State University, Long Beach, with an MBA degree in 1993.Journalism.

Debra P. Hellweg, age 41,44, was appointed Vice President, Operations in June 2008. She has been employed by the Company since 2004 and served as Director of Internal Audit from 2004 to 2008. Prior to her employment with the Company, Ms. Hellweg was a Manager with Deloitte & Touche LLP and Vice President & Auditor of Southwest Bank of St. Louis. Ms. Hellweg has a B.S.B.A. degree in Accounting from the University of Missouri and an MBA from Webster University and is a CIA.

| 5 |

CORPORATE GOVERNANCE AND

THE BOARD OF DIRECTORS

General

The business and affairs of the Company are managed under the direction of the Board of Directors in accordance with the General Corporation Law of the State of Delaware and the Company’s ArticlesSecond Amended and Restated Certificate of Incorporation and Bylaws, as amended. Members of the Board are kept informed of the Company’s business through discussions with the Chairman and Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees.

FromFor the period from May 2012 until Michael Smith’s resignation on January 17, 2013 to May 2014, the Board of Directors of the Company had sevenfive members. From January 17, 2013Since May 2014 to the present, the Board had sixhas seven members. The Board met sevenfive times during 2012.2015. During 2012,2015, no director attended less than 75% of the combined Board of Directors and Committee meetings. The Board has determined that Messrs. Akin, Klimek, Smith and St. JohnHenry are independent based on the application of the rules and standards of theNasdaq Stock Market.

Board Leadership Structure

As is often common practice among public companies of our size in the United States, our Board of Directors has appointed the Company’s Chief Executive Officer to serve as Chairman of the Board. In his position as Chief Executive Officer, Mr. Montgomery is responsible for the direction and leadership of the Company and oversees the development and execution of the Company’s strategic plans. In his role as Chairman of the Board, he presides over the meetings of the Board of Directors and communicates the decisions and directives of the Board to management. The Board of Directors believes that the combination of these two roles provides the most efficient and effective leadership model for the Company by enhancing the Chairman and Chief Executive Officer’s ability to provide perspective and direction with regard to business strategies and plans to both the Board and management, allowing for unified leadership and focus.

Notwithstanding the Board’s decision to appoint the Chief Executive Officer as Chairman of the Board of Directors, the Company has no bylaw or policy in place that mandates that the Chief Executive Officer serve as the Chairman of the Board. Our Board of Directors recognizes that depending on the circumstances, other leadership models, such as a separate independent Chairman of the Board, might be appropriate. Accordingly, the Board of Directors periodically evaluates its leadership structure.

The Board of Directors has not appointed a lead independent director at this time. The Board has evaluated whether appointing a lead independent director facilitates the ability of the Company’s independent directors to carry out their duties. The independent directors of the Board attend at least one executive session, and may call such further sessions as they deem necessary, at which only independent directors are present and at which the independent directors are free to discuss any aspect of the Company’s business and risk management without the influence of interested directors or management. In addition, all members of the Company’s Audit, Nominating and Compensation committeesCommittees have been determined by the Board of Directors to be independent based on the application of the rules and standards of the NASDAQ Stock Market.

Board Role in Risk Oversight

The Board of Directors plays an active role, as a whole and at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information regarding our credit, liquidity and operations, as well as the risks associated with each. The Audit Committee oversees management of financial risks through regular meetings with the Company’s independent registered public accounting firm and the Company’s Chief Financial Officer and Manager of Internal Audit. The Company’s Compensation Committee evaluates and addresses risks relating to executive compensation, our incentive compensation plans and other compensatory arrangements. The Nominating Committee manages risks associated with the independence of the Board of Directors and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of those risks, the entire Board of Directors is regularly informed through committee reports and management presentations to the full Board about these and other operational risks.

| 6 |

Committees of the Board of Directors

The Board of Directors has standing Executive,Audit, Nominating, and Compensation Nominating, Audit and International Committees.

The Executive Committee acts on various matters between meetings of the Board of Directors. The Executive Committee consists of Messrs. Montgomery, Merrick and Hastings. The Executive Committee did not have any meetings during 2012.

The Company has established an International Committee to review and advise with respect to the international operations of the Company. The International Committee consists of Messrs. Klimek and Merrick and includes several members of management. The International Committee met four times in 2012.

Audit Committee

Since 2000, the Company has had a standing Audit Committee, which is presently composed of Messrs. St. John, AkinHenry (Chairman), Klimek, and Klimek.Thibodeau. Mr. St. JohnHenry has been designated and is the Company’s “Audit Committee Financial Expert” pursuant to Item 401 of Regulation S-K of the Securities Exchange Act of 1934. The Audit Committee held eight meetings during fiscal year 2012,2015, including quarterly meetings with management, the Company’s Vice President, Operations, the Manager of Internal Audit and the independent registered public accounting firm to discuss the Company’s financial statements and control systems. Mr. St. JohnHenry and each appointed member of the Committee satisfies the definition of “independent” as that term is defined in the rules governing companies whose stock is traded on theNasdaq Stock Market. The Board of Directors has adopted a written charter for the Audit Committee. A copy of the Audit Committee Charter has been posted and can be viewed on the Company’s Internet website at http://www.reliv.com under the section entitled “Investor Relations.” In addition, the Audit Committee has adopted a complaint monitoring procedure to enable confidential and anonymous reporting to the Audit Committee of concerns regarding, among other things, questionable accounting or auditing matters.

Report of the Audit Committee

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management and the Company’s independent registered public accounting firm, Ernst & Young LLP, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and internal controls.

The Audit Committee reviewed with the independent registered public accounting firm, which is responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s application of accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditingin accordance with the standards of the Public Company Accounting Oversight Board (U.S.) (“PCAOB”) including but not limited to those matters required to be discussed by SAS 61 (Codification of Statements onPCAOB Auditing Standards, AU §380, as amended).Standard No. 16. In addition, the Audit Committee has discussed with the independent registered public accounting firm their independence from management and the Company including the matters in the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight BoardPCAOB regarding its communications with the Audit Committee concerning independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit of the Company’s financial statements and the effectiveness of internal controls over financial reporting.statements. The Audit Committee meets with the internal auditor and independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

| 7 |

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 20122015 for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors have also recommended, subject to stockholder approval, the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm.

Denis St. John,Robert M. Henry, Audit Committee Chair

John B. Akin, Member

John M. Klimek, Member

David T. Thibodeau, Member

Nominating Committee

In May 2004, the Company established aThe Nominating Committee. The Nominatingand Governance Committee consists of twothree directors, Messrs. Akin (Chairman), Klimek and St. John.Henry. The Nominating Committee does not have a charter. The Board of Directors has determined that each of the members of the Nominating Committee is independent as defined in the listing standards for theNasdaq StockMarket.

The Nominating Committee has not adopted a formal policy with regard to consideration of director candidates recommended by security holders. The Company believes that the continuing service of qualified incumbent members of the Board of Directors promotes stability and continuity at the Board level, contributes to the Board’s ability to work as a collective body and provides the benefit of familiarity and insight into the Company’s affairs. Accordingly, the process of the Nominating Committee for identifying nominees reflects the Company’s practice of re-nominating incumbent directors who continue to satisfy the criteria for membership on the Board. For vacancies which are anticipated on the Board of Directors, the Nominating Committee intends to seek out and evaluate potential candidates from a variety of sources that may include recommendations by security holders, members of management and the Board of Directors, consultants and others. The minimum qualifications for potential candidates for the Board of Directors include demonstrated business experience, decision-making abilities, personal integrity and a good reputation. While diversity is not a leading factor in the Nominating Committee’s evaluation of potential candidates and there is no formal policy for considering diversity when nominating a potential director, it is a consideration that is evaluated along with other qualifications of potential candidates. In light of the foregoing, it is believed that a formal policy and procedure with regard to consideration of director candidates recommended by security holders is not necessary in order for the Nominating Committee to perform its duties.

The Nominating Committee met twicedid not meet in 2012.2015. All of the independent directors of the Board of Directors participated in the nominating process and, in separate session, voted in favor of recommending to the Board of Directors the nomination of each of the nominees for election as directors.

Compensation Committee

The Compensation Committee consists of three directors: Messrs. St. JohnKlimek (Chairman), KlimekHenry and Akin. The Board has determined that each of the members of the Compensation Committee is independent as defined in the listing standards for theNasdaq Stock Market. The Compensation Committee reviews and acts on the Company’s executive compensation and employee benefit and retirement plans, including their establishment, modification and administration. It also determines the compensation of the Chief Executive Officer and certain other executive officers, including incentive compensation programs and stock options. The Compensation Committee has a charter which has been posted and can be viewed on the Company’s Internet website at http://www.reliv.com under the section entitled “Investor Relations.” The Compensation Committee met fivefour times in 2012.2015.

| 8 |

EXECUTIVE COMPENSATION

The Company is a “smaller reporting company” under Item 10 of Regulation S-K promulgated under the Securities Exchange Act of 1934 and has elected to comply with certain of the requirements applicable to smaller reporting companies in connection with this proxy statement.

SUMMARY COMPENSATION TABLE

The following table sets forth the annual and long-term compensation for the fiscal years ended December 31, 20122015 and 2011,2014, respectively, of the Company’s Principal Executive Officer and each of the two other most highly compensated executive officers. These individuals, including the Chief Executive Officer, are collectively referred to in this proxy statement as the Named Executive Officers.

| Non-Equity | All Other | |||||||||||||||||||||||

| Option | Incentive Plan | Compensation | ||||||||||||||||||||||

| Name and Principal Position | Year | Salary | Awards (1) | Compensation (2) | (3, 4, 5, 6, 7, 8) | Total | ||||||||||||||||||

| Robert L. Montgomery | 2012 | $ | 642,625 | $ | 22,985 | $ | 11,690 | $ | 75,646 | $ | 752,946 | |||||||||||||

| Chairman and Chief Executive | 2011 | $ | 642,625 | $ | 42,842 | $ | 32,200 | $ | 54,822 | $ | 772,489 | |||||||||||||

| Officer | ||||||||||||||||||||||||

| Carl W. Hastings | 2012 | $ | 360,000 | $ | 14,095 | $ | 11,690 | $ | 34,572 | $ | 420,357 | |||||||||||||

| Vice Chairman, Chief Scientific | 2011 | $ | 360,000 | $ | 18,073 | $ | 11,760 | $ | 33,101 | $ | 422,934 | |||||||||||||

| Officer | ||||||||||||||||||||||||

| R. Scott Montgomery | 2012 | $ | 202,000 | $ | 7,589 | $ | 46,760 | $ | 18,607 | $ | 274,956 | |||||||||||||

| President, Reliv Asia-Pacific | 2011 | $ | 202,000 | $ | 11,567 | $ | 38,864 | $ | 21,578 | $ | 274,009 | |||||||||||||

______________________

| Non-Equity | All Other | |||||||||||||||||||||

| Option | Incentive Plan | Compensation | ||||||||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Awards (1) | Compensation (2) | (3, 4, 5, 6, 7) | ||||||||||||||||

| Robert L. Montgomery | 2015 | $ | 610,494 | $ | - | $ | - | $ | - | $ | 62,015 | |||||||||||

| Chairman and Chief Executive | 2014 | $ | 631,915 | $ | - | $ | - | $ | 3,348 | $ | 67,298 | |||||||||||

| Officer | ||||||||||||||||||||||

| Carl W. Hastings | 2015 | $ | 342,000 | $ | - | $ | - | $ | - | $ | 28,368 | |||||||||||

| Vice Chairman, Chief Scientific | 2014 | $ | 354,000 | $ | - | $ | - | $ | 3,348 | $ | 30,855 | |||||||||||

| Officer | ||||||||||||||||||||||

| Donald E. Gibbons, Jr. | 2015 | $ | 144,000 | $ | 84,946 | $ | 18,882 | $ | - | $ | - | |||||||||||

| Sr. Vice-President, U.S. Sales | 2014 | $ | 111,080 | $ | 19,091 | $ | - | $ | - | $ | - | |||||||||||

| (1) | Reflects the compensation expense recognized in |

| (2) | Amounts determined solely under the Company’s Incentive Compensation Plan. No amounts were earned under the Plan in 2015. |

| (3) | Amounts for |

| (4) |

| (5) | Amounts for |

| (6) | Amounts for |

| (7) |

| All Other Compensation amount for Robert L. Montgomery includes financial planning services of |

| 9 |

Narrative Disclosure Forfor Summary Compensation Table

Employment Agreements with Our Named Executive Officers

In June 2007, the Company entered into an Employment Agreement with Robert L. Montgomery replacing a prior agreement. The agreement, as amended, is for a term of employment commencing on January 1, 2007 and expiring on December 31, 2009 with a provision for automatic one-year renewal terms, and provides for Mr. Montgomery to receive base annual compensation during the term of not less than $600,000. Mr. Montgomery is also to participate in the Company’s annual incentive compensation and the Company’s long-term equity incentive compensation plans and such other compensation plans as the Company may from time to time have for executives. In the event of Mr. Montgomery’s death during the term of the agreement, payments equal to the total compensation that would have been paid to Mr. Montgomery under the agreement, but for his death, will be made to his heirs for a period of six months. The agreement also allows Mr. Montgomery the option to reduce his level of service to the Company by approximately one-half with a corresponding decrease in base annual compensation and a reduction of 25% of his incentive compensation, after a requisite waiting period. Mr. Montgomery also has the option to terminate his active service and continue in a consulting capacity. The term of the consulting period will be 15 years and Mr. Montgomery will receive approximately 30% of his prior average annual cash compensation over the five years immediately preceding the earlier of (1) his election to terminate his employment and continue to serve the Company as a consultant or (2) his election to continue his employment at a reduced rate of service and compensation. The agreement includes the obligation of Mr. Montgomery to maintain the confidentiality of the Company’s confidential information and contains a covenant of Mr. Montgomery not to compete with the Company. In addition, for a period of at least 20 years following the termination of the agreement, the Company has the right to continue its use of Mr. Montgomery’s name and likeness in consideration of a $10,000 annual fee paid to Mr. Montgomery or his heirs.

In December 2011,March 2014, the Company entered into an Employment Agreement with Dr. Hastings replacingeffective as of January 2013 that replaced a prior agreement. The term of employment under the agreement as amended, wasis for a period commencing on JulyJanuary 1, 20062013 and expiring on December 31, 2012; provided, however,2019. For the parties have agreedperiod from January 1, 2013 to extend the agreement on a month-to-month basis. During the term of employment, the Company is obligated to payDecember 31, 2016, Dr. Hastings a basicis to devote full time to his duties and is to receive base salary at the rate of $30,000 per month. For the period from January 1, 2017 to December 31, 2019, he is to devote approximately one-half of his time to his duties and is to receive a base salary at the rate of $22,500 per month. Dr. Hastings is also to participate in the Company’s annual incentive compensation and the Company’s long-term equity incentive compensation plans and such other compensation plans as the Company may from time to time have for executives. Upon expiration of the term of employment and a requisite waiting period, Dr. Hastings will be retained to provide consulting services to the Company for a term expiring on June 30, 2021.2029. During the consulting term, the Company will pay Dr. Hastings the sum of $12,000$13,000 per month, such amount to be adjusted periodically based upon changes in the National Consumer Price Index. In the event of Dr. Hastings’ death during the term of the agreement, payments equal to the cash compensation that would have been paid to Dr. Hastings under the agreement, but for his death, will be made to his heirs for a period of six months. During the term of the agreement, and thereafter for a period of 20 years in consideration of the payment of $10,000 annually, the Company will be entitled to use the name and likeness of Dr. Hastings in connection with the Company’s promotional materials and activities. The agreement also includes the obligation of Dr. Hastings to maintain the confidentiality of the Company’s confidential information and to hold any and all inventions made or conceived by him during the term of the agreement as the Company’s fiduciary and a covenant of Dr. Hastings not to compete with the Company. Since December 31, 2012, the terms of the agreement have remained in effect on a month-to-month basis while Dr. Hastings and the Company negotiate a new employment agreement.

In January 2008,On September 16, 2014, the Company entered into an Employment Agreement with R. Scott MontgomeryDonald E. Gibbons, Jr. to employ Mr. Gibbons as Senior Vice President of U.S. Sales. The term of employment under which Mr. Montgomery was employed as an executive of the Company. The agreement is for a termperiod of one year withfive years expiring on September 30, 2019. Mr. Gibbons is to devote full time to his duties and is to receive a provision for automatic one-year renewal terms,base salary at the rate of $12,000 per month and provides for base annualadditional compensation equal to 0.15% of $202,000.retail sales in the United States. Mr. MontgomeryGibbons is also to participate in the Company’s annuallong-term equity incentive compensation planplans and such other compensation plans as the Company may from time to time have for executives. The agreement provides that, inIn the event of termination (other than termination for default or permanent mental or physical disability), Mr. Montgomery will receive a severance paymentGibbon’s death during the term of the agreement, payments equal to $101,000, payable overthe cash compensation that would have been paid to Mr. Gibbons under the agreement, but for his death, will be made to his heirs for a 12-month period.period of six months. The agreement also includes the obligationsobligation of Mr. MontgomeryGibbons to maintain the confidentiality of the Company’s confidential information, to hold any and hold certainall inventions formade or conceived by him during the Company in histerm of the agreement as the Company’s fiduciary capacity, and contain a covenant of Mr. Gibbons not to solicitcompete with the Company’s distributors for a period of two years after the date of termination of the agreement.Company.

Base Salaries

For 2012, there was no adjustment to the base salaries of Messrs. Robert L. Montgomery, Carl Hastings and R. Scott Montgomery.

| 10 |

Information Relating to Cash Incentives and Stock and Option Awards

Effective January 1, 2007, the Board of Directors, on the recommendation of the Compensation Committee, adopted an Incentive Compensation Plan providing for annual incentive compensation to be paid to executive and managerial employees of the Company. Under the Plan, designated Named Executive Officers and a number of other executive officers and managers receive incentive compensation payments, determined on a quarterly and annual basis, which are based upon the income from operations of the Company for the period if the profits exceed a threshold amount of quarterly income from operations in the amount of $500,000. The benefits under the Plan are divided into two Pools of compensation. Pool I (representing the largest pool of incentive compensation) covers senior executive officers who participate in the pool of incentive compensation based upon a percentage allocation made by the Compensation Committee each year. Pool II covers other executives and managers who are selected to participate in proportions determined by senior management. The Compensation Committee believes such incentive compensation motivates participants to achieve strong profitability which is viewed as the most significant element of corporate performance, provides rewards for strong corporate performance and aligns the incentive with the interests of the stockholders. Incentive compensation participation levels are generally determined during the first quarter of each fiscal year.

With respect to Pool I participants, (other than the Chief Executive Officer whose participation is determined solely by the Compensation Committee and the Board of Directors), the Compensation Committee, in consultation with management and the Chief Executive Officer, determines the participants and their relative level of participation during the first quarter of the year.year for a recommendation to the Board of Directors for formal approval. In determining participation and the level of participation each year, management and the Compensation Committee considers the executive’s responsibilities and individual performance during the prior year. For the fiscal year ended December 31, 2015, no amounts were earned under the Incentive Compensation Plan.

Long-Term Equity Incentives

Prior to May 2009, long-term incentive awards were granted to executives under the 2003 Stock Option Plan approved by the stockholders in May 2003. At the Company’s Annual Meeting of Stockholders held in May 2009,2014, the Company’s 20092014 Incentive Stock Plan was approved by the stockholders. The Plan provides for the issuance of stock options or incentive stock grants of up to 1,000,000 shares of common stock of the Company. Upon approval by the stockholders of the 20092014 Incentive Stock Plan, the Board provided that no further grants of option awards shall be made under any prior plan, and, since such time, stock options have been issued pursuant to the 20032014 Incentive Stock Option Plan. As of December 31, 2012, 775,0002015, 915,000 shares subject to option awards have been granted to certain executive officers and senior management of the Company under the 20092014 Incentive Stock Plan.

Stock option grants are determined from time to time by the Compensation Committee in consultation with management. The actual grant for each executive is determined taking into consideration (i) individual performance, (ii) corporate performance and (iii) prior grants to, or stock ownership of the Company by, the executive. Generally, stock options are granted with an exercise price equal to or greater than the closing price of the Company’s common stock on the NASDAQ Global Select Market on the date of the grant.

In 2007, the Company adopted a policy concerning the grant of stock options pursuant to which, unless otherwise approved by the Board of Directors, the Compensation Committee will only approve the grant of stock options during a period of time that begins 3 business days after the earnings press release after the second quarter of each fiscal year and ends at the 8th business day after such second quarter earnings release.

In 2012,2015, the Board of Directors authorized the following grants of stock options to the Named Executive Officer.Officer:

Robert L. MontgomeryMr. Gibbons was awarded threeincentive stock options totaling 200,000 shares in 2012. The first option grant was a non-qualified stock option for 64,250115,000 shares with a term of five years and a price of $1.20,$1.11, the closing price of the Company’s stock on the NASDAQ exchange on the day before grant. TheThese options becomewere issued in three separate grants:

| 11 |

One grant for 34,500 shares vests in 20% increments on each of March 10, 2016 through 2019, with the final 20% vesting on January 1, 2020. A second grant for 40,250 shares becomes fully vested when the Company’s consolidated trailing twelve-month Income from Operations exceeds $2.0 million, as reported in the Company’s financial statements filed with the SEC, excluding the expense recognition of all performance-based stock options under ASC 718. A third grant for an additional 40,250 shares becomes fully vested when the Company’s consolidated trailing twelve-month Income from Operations exceeds $4.3 million, as reported in the Company’s financial statements filed with the SEC, excluding the expense recognition of all performance-based stock options under ASC 718, and718. All three grants expire on JanuaryMarch 10, 2017. The second option grant was an incentive stock option for 35,750 shares with a term of five years and a price of $1.32, 110% of the closing price of the Company’s stock on the NASDAQ exchange on the day before grant. The options become fully vested when the Company’s consolidated trailing twelve-month Income from Operations exceeds $4.3 million, as reported in the Company’s financial statements filed with the SEC, excluding the expense recognition of all performance-based stock options under ASC 718, and expire on January 10, 2017. The third option grant was an incentive stock option for 100,000 shares with a term of five years and a price of $1.32, 110% of the closing price of the Company’s stock on the NASDAQ exchange on the day before grant. The options vest ratably on each of January 11, 2013, January 11, 2014, January 11, 2015, January 11, 2016 and November 1, 2016 and expire on January 10, 2017.

Each of Dr. Carl Hastings and R. Scott Montgomery was awarded two stock options totaling 80,000 shares in 2012. The first option grant was an incentive stock option for 40,000 shares with a term of five years and a price of $1.20, the closing price of the Company’s stock on the NASDAQ exchange on the day before grant. The options become fully vested when the Company’s consolidated trailing twelve-month Income from Operations exceeds $4.3 million, as reported in the Company’s financial statements filed with the SEC, excluding the expense recognition of all performance-based stock options under ASC 718, and expire on January 10, 2017. The second option grant was an incentive stock option for 40,000 shares with a term of five years and a price of $1.20, the closing price of the Company’s stock on the NASDAQ exchange on the day before grant. The options vest ratably on each of January 11, 2013, January 11, 2014, January 11, 2015, January 11, 2016 and November 1, 2016 and expire on January 10, 2017.

In each case, the option term was for a period of five years and the option exercise price is $9.74 per share, the closing share price on the date of grant. The options vest ratably on each of August 7, 2009, August 7, 2010, August 7, 2011 and May 1, 2012 and expire on August 7, 2012.2020.

We view participation by our executives in our Employee Stock Ownership Plan (the “ESOP”) as a component of long-term compensation. Shares purchased by the Plan,ESOP, or contributed to the Plan,ESOP, are allocated among participants based upon relative eligible compensation levels and subject to the vesting requirements of the Plan.ESOP.

Retirement Benefits

The Company maintains a 401(k) employee savings plan (the “401(k) Plan”) in which all salaried employees that have met the plan’s service requirements are eligible to participate. The Company also maintains an Employee Stock Ownership Plan,the ESOP, which was adopted by the Company on September 1, 2006. Both plans are tax qualified retirement plans.

Under the 401(k) Plan, employees may contribute up to 15% of their eligible compensation to the 401(k) Plan and the Company will contribute a matching amount to the 401(k) Plan each year. The federal statutory limit for eligible compensation in 20122015 was $255,000.$265,000. Participating employees may direct the investment of individual and company contributions into one or more of the investment options offered by the 401(k) Plan, provided that, for new contributions, employees may not invest more than 15% in common stock of the Company. During 2012,2014, the Company made matching contributions of 25% of the amount contributed by employeeson employee contributions to the 401(k) Plan until October 1, 2014, and 10% thereafter, subject to statutory limits and top-heavy plan rules. The Company’s contributions to the 401(k) planPlan totaled approximately $145,000$49,300 in 2012,2015, which is subject to the vesting requirements of the 401(k) Plan.

Under the ESOP, all employees of the Company are eligible to participate in the ESOP and interests in the ESOP are allocated to participants based on relative eligible compensation. All contributions to the ESOP are made by the Company in the form of cash or stock and are discretionary. The maximum amount of contribution which the Company can make is 25% of the annual eligible compensation of employees after taking into account contributions to the 401(k) Plan. During 2012, the Company contributed $125,000 to the ESOP. Shares of stock purchased by, or contributed to the Plan,ESOP, are allocated to participants based on qualified compensation and subject to the vesting requirements of the Plan.ESOP. During 2015, the Company elected not to make a contribution to the ESOP.

Other Benefits

The Company provides certain general employee benefits and health insurance plans of the type commonly offered by other employers. These benefits form part of our compensation philosophy because the Company believes they are necessary in order to attract, motivate and retain talented executives.

Supplemental Executive Retirement Plan

The Company sponsored a Supplemental Executive Retirement Plan (SERP)(the “SERP”) that previously allowed certain executives to defer a portion of their annual salary and bonus into a grantor trust. A grantor trust was established to hold the assets of the SERP. The Company funded the grantor trust by paying the amount deferred by the participant into the trust at the time of deferral. Investment earnings and losses accrue to the benefit or detriment of the participants. The SERP also provided for a discretionary matching contribution by the Company not to exceed 100% of the participant’s annual contribution. The participants fully vested in the deferred compensation three years from the date they entered the SERP. The participants are not eligible to receive distributions under the SERP until retirement, death, or disability of the participant.

| 12 |

In 2006, the SERP was amended to provide, among other things, that no new participants may be designated and no new or additional salary deferrals may be made. Accordingly, none of the named executive officers made a contribution to the SERP in 20122015 and no Company additions or matches were provided. Carl W. Hastings is the only current executive officer of the Company who is a participant in the SERP.

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 20122015

The following table sets forth all outstanding equity awards to Named Executive Officers as of December 31, 2012.2015. All awards are in the common stock of the Company.

| Option Awards | ||||||||||||||||||||

| Equity incentive | ||||||||||||||||||||

| plan awards: | ||||||||||||||||||||

| Number of Securities Underlying | Number of Securities | Option | Option | |||||||||||||||||

| Unexercised Options (#) | Underlying Unexercised | Exercise | Expiration | |||||||||||||||||

| Name | Exercisable | Unexercisable | Unearned Options (#) | Price ($) | Date | |||||||||||||||

| Robert L. Montgomery | 60,000 | 40,000 | - | $ | 1.32 | 1/10/2017 | (1) | |||||||||||||

| - | - | 35,750 | 1.32 | 1/10/2017 | (2) | |||||||||||||||

| - | - | 64,250 | 1.20 | 1/10/2017 | (2) | |||||||||||||||

| Carl W. Hastings | 24,000 | 16,000 | - | 1.20 | 1/10/2017 | (1) | ||||||||||||||

| - | - | 40,000 | 1.20 | 1/10/2017 | (2) | |||||||||||||||

| Donald E. Gibbons, Jr. | 12,000 | 8,000 | - | 1.20 | 1/10/2017 | (1) | ||||||||||||||

| - | - | 20,000 | 1.20 | 1/10/2017 | (2) | |||||||||||||||

| - | - | 19,000 | 1.17 | 3/8/2018 | (2) | |||||||||||||||

| - | 34,500 | - | 1.11 | 3/10/2020 | (3) | |||||||||||||||

| - | - | 40,250 | 1.11 | 3/10/2020 | (4) | |||||||||||||||

| - | - | 40,250 | 1.11 | 3/10/2020 | (2) | |||||||||||||||

| Option Awards | ||||||||||||||||||||||

| Equity incentive | ||||||||||||||||||||||

| Number of Securities | plan awards: | |||||||||||||||||||||

| Underlying | Number of Securities | Option | Option | |||||||||||||||||||

| Unexercised Options (#) | Underlying Unexercised | Exercise | Expiration | |||||||||||||||||||

| Name | Exercisable | Unexercisable | Unearned Options (#) | Price ($) | Date | |||||||||||||||||

| Robert L. Montgomery | 160,000 | - | - | $ | 7.92 | 1/5/2015 | (1) | |||||||||||||||

| - | 100,000 | - | 1.32 | 1/10/2017 | (2) | |||||||||||||||||

| - | - | 35,750 | 1.32 | 1/10/2017 | (3) | |||||||||||||||||

| - | - | 64,250 | 1.20 | 1/10/2017 | (3) | |||||||||||||||||

| Carl W. Hastings | 20,000 | - | - | 7.92 | 1/5/2015 | (1) | ||||||||||||||||

| 16,500 | - | - | 5.28 | 8/28/2013 | (4) | |||||||||||||||||

| - | 40,000 | - | 1.20 | 1/10/2017 | (2) | |||||||||||||||||

| - | - | 40,000 | 1.20 | 1/10/2017 | (3) | |||||||||||||||||

| R. Scott Montgomery | 50,000 | - | - | 7.92 | 1/5/2015 | (1) | ||||||||||||||||

| - | 40,000 | - | 1.20 | 1/10/2017 | (2) | |||||||||||||||||

| - | - | 40,000 | 1.20 | 1/10/2017 | (3) | |||||||||||||||||

______________________

| (1) |

| (2) | Stock options granted to the named executive officer |

| Stock option granted to the named executive officer vests in |

| (4) | Stock options granted to the named executive officer become fully vested when the Company’s consolidated trailing twelve-month Income from Operations exceeds $2.0 million, as reported in the Company’s financial statements filed with the SEC, excluding the expense recognition of all performance-based stock options under ASC 718. |

The Company has not issued any stock awards.

| 13 |

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth the common stock of the Company authorized for issuance under the Company’s equity compensation plans as of December 31, 2012.2015.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities for future issuance | ||||||||||||||||||

| Equity compensation plans approved by security holders | 1,313,500 | $ | 3.94 | 225,000 | (1) | 1,832,000 | $ | 1.16 | 25,000 | (1) | ||||||||||||||

| Equity compensation plans not approved by security holders | - | - | - | - | - | - | ||||||||||||||||||

| Total | 1,313,500 | $ | 3.94 | 225,000 | 1,832,000 | $ | 1.16 | 25,000 | ||||||||||||||||

______________________

| (1) |

Payments upon Termination or Change of Control

The Company has no agreements with Named Executives or other executives of the Company under which payments are to be made in the event of change of control of the Company.

Under the Employment Agreement between the Company and Robert L. Montgomery, Mr. Montgomery has the right, to reduce his level of service to the Company by approximately one-half with a corresponding decrease in position and base annual compensation and a 25% decrease in incentive compensation. Mr. Montgomery also has the option to terminate his active service and continue in a consulting capacity. The term of the consulting period will be 15 years and Mr. Montgomery will receive approximately 30% of his prior average annual compensation over the previous five years or last five years of his full-time employment as a consulting fee. In the event of Mr. Montgomery’s death during the term of the agreement, payments equal to his total compensation under the agreement will be made to his heirs for a period of six months. In addition, for a period of 20 years following termination of the agreement, the Company has the right to continue its use of Mr. Montgomery’s name and likeness in consideration of a $10,000 annual fee payable to Mr. Montgomery or his heirs.

Under the Employment Agreement between the Company and Carl W. Hastings, upon expiration of the term of employment, Dr. Hastings will be retained to provide consulting services to the Company through June 30, 2021.2028. During the consulting term, the Company will pay Dr. Hastings the sum of $12,000$13,000 per month, such amount to be adjusted periodically based upon changes in the National Consumer Price Index. In the event of Dr. Hastings’ death during the term of the agreement, payments equal to his cash compensation under the agreement will be made to his heirs for a period of six months. In addition, for a period of 20 years following termination of the agreement, the Company has the right to continue its use of Dr. Hastings’ name and likeness in consideration of a $10,000 annual fee payable to Dr. Hastings or his heirs.

Under the Employment Agreement between the Company and Donald E. Gibbons, Jr., Mr. Gibbons may terminate the agreement by providing the Company with 180 days’ notice. The Company may terminate the agreement prior to the expiration of R. Scott Montgomery in the event of his termination for reasons other thanterm upon an event of default by Mr. Gibbons or upon the permanent mental or physical disability, he will receive severance of $101,000, payable in equal installments over a 12-month period. The agreement includes the obligationsincapacity of Mr. Montgomery to maintainGibbons. In the confidentialityevent of termination by the Company or Mr. Gibbons, the Company will pay Mr. Gibbons for all accrued compensation through the date of termination. In the event of Mr. Gibbon’s death during the term of the Company’s confidential informationagreement, the agreement immediately terminates and hold certain inventionspayments equal to the cash compensation that would have been paid to Mr. Gibbons under the agreement, but for the Company in his fiduciary capacity, and contains a covenant notdeath, will be made to solicit the Company’s distributorshis heirs for a period of two years after the date of termination of the agreement.six months.

| 14 |

DIRECTOR COMPENSATION

| Name | Fees Earned or Paid in Cash ($) | Option Awards(1) | All Other Compensation ($) | Total ($) | ||||||||||||

| Stephen M. Merrick | $ | - | $ | - | $ | 216,000 | $ | 216,000 | ||||||||

| John B. Akin | 41,000 | - | - | 41,000 | ||||||||||||

| John M. Klimek | 43,000 | - | - | 43,000 | ||||||||||||

| Robert M. Henry | 43,000 | - | - | 43,000 | ||||||||||||

| David T. Thibodeau | 42,000 | - | - | 42,000 | ||||||||||||

| Name | Fees Earned orPaid in Cash ($) | Option Awards(1) | All Other Compensation ($) | Total ($) | ||||||||||||

| Stephen M. Merrick(2) | $ | - | $ | 5,008 | $ | 247,417 | $ | 252,425 | ||||||||

| Denis St. John | 58,500 | 2,845 | - | 61,345 | ||||||||||||

| John B. Akin | 48,000 | 1,661 | - | 49,661 | ||||||||||||

| Michael Smith | 60,000 | 1,428 | - | 61,428 | ||||||||||||

| John M. Klimek | 57,000 | 233 | - | 57,233 | ||||||||||||

(footnotes on following page)

______________________

| (1) |

| Name | ||||

| Stephen M. Merrick | ||||

| John B. Akin | 5,000 | |||

| John M. Klimek | 5,000 | |||

| Robert M. Henry | — | |||

| David T. Thibodeau | — |

Narrative Description of Director Compensation

Members of the Board of Directors who are not employees receive a monthly fee of $2,500$2,000 and $1,500 per attendance at meetings in person of the Board of Directors or any committees of the Board of Directors, and $1,000 per attendance at meetings via conference call, up to a maximum of $3,000 per day. See footnote 2 to the Director Compensation Table for an explanation of Mr. Merrick’s compensation.

Certain Relationships and Related Transactions

Robert L. Montgomery, the Chief Executive Officer and Chairman of the Board, is the father of R. Scott Montgomery and Ryan A. Montgomery. Ryan A.R. Scott Montgomery is the President of Reliv Asia Pacific and as a result of serving in such capacity, the Company paid him cash compensation of $241,160$207,100 in 20122015 and $229,020$227,225 in 2011.2014. Ryan A. Montgomery is President of the Company and as a result of serving in such capacity, the Company paid him cash compensation of $196,190 in 2015 and $215,922 in 2014. Ronald McCain is the son-in-law of the Chief Executive Officer and Chairman of the Board, Robert L. Montgomery. Ronald McCain iswas Vice President – Sales Development and as a resultuntil June 1, 2014. On June 1, 2014, Mr. McCain became an independent distributor of serving in such capacity, the CompanyCompany. He was paid him cash compensation of $177,119$156,350 in 2012aggregate in 2014 for his prior position and $176,739 in 2011.his new role with the Company. In 2015, he was paid cash compensation of $137,261 as an independent distributor of the Company.

Dr. Carl W. Hastings, Vice Chairman, Chief Scientific Officer and director, is the father of Steven G. Hastings and Brett M. Hastings. Steven G. Hastings is SeniorExecutive Vice President, North American Sales and Marketing and as a result of serving in such capacity, the Company paid him cash compensation of $215,270$181,750 for 20122015 and $213,436$197,627 for 2011.2014. Brett M. Hastings is Senior Vice President-LegalPresident, Chief Operating Officer and as a result of serving in such capacity, the Company paid him cash compensation of $199,535$173,300 for 20122015 and $195,041$186,833 for 2011.2014.

| 15 |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers and directors, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission and with theNasdaq Stock Market. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such forms furnished to the Company, or written representations that no Form 5’s were required, the Company believes that during calendar year 2012,2015, all of the officers, directors and ten percent beneficial owners of the Company complied with all applicable Section 16(a) filingrequirements,except that on one occasion each of Mr. Robert L.Ryan A. Montgomery Michael D. Smith and Joseph J. Wojcik filed a nominally late Form 4 for a transaction.

Code of Ethics

The Company has adopted a code of ethics that applies to senior executive and financial officers. The Company’s Code of Ethics seeks to promote (1) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, (2) full, fair, accurate, timely and understandable disclosure of information to the Commission, (3) compliance with applicable governmental laws, rules and regulations, (4) prompt internal reporting of violations of the Code of Ethics to predesignated persons, and (5) accountability for adherence to the Code of Ethics. A copy of the Company’s Code of Ethics has been posted to and can be viewed on the Company’s Internet website at http://www.reliv.com under the section entitled “Investor Relations.”

PROPOSAL TWO - SELECTIONAPPROVAL OF AUDITORSAN AMENDMENT TO THE COMPANY’S SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK

Ratification of Appointment of Independent Registered Public Accounting Firm

The Board of Directors (“Board”) has adopted and is submitting for stockholder approval an amendment to our Second Amended and Restated Certificate of Incorporation to effect a reverse stock split at a ratio that is not less than 1:3 nor greater than 1:7, with the final ratio to be selected by the Board in its discretion following stockholder approval. As the Company is a Delaware corporation, the Board must recommend and communicate the basis for its determination as to any amendment to our Second Amended and Restated Certificate of Incorporation, and submit the amendment to stockholders for their approval. Approval of Proposal Two requires the vote of a majority of the issued and outstanding shares entitled to vote.

The proposed amendment to our Second Amended and Restated Certificate of Incorporation includes a range of exchange ratios for the reverse stock split because it is not possible to predict market conditions at the time the reverse split would be implemented. If stockholders approve this proposal at the annual meeting, the Board will be authorized to implement a reverse stock split at a ratio within the range, or to abandon the reverse stock split as determined in the discretion of the Board. This authorization will remain effective until the first anniversary of the annual meeting, or, if shorter, until the Company regains compliance with the NASDAQ Stock Market (“NASDAQ”) listing requirements as further described below, including any extensions granted by NASDAQ to regain compliance, or the Company is delisted. The Board will set the ratio for the reverse stock split or abandon the reverse stock split as it determines what is advisable and in the best interests of the Company considering relevant market conditions at the time the reverse stock split is to be implemented or abandoned. No further action on the part of the stockholders would be required to either effect a reverse stock split or abandon it.

The form of the proposed amendment to our Second Amended and Restated Certificate of Incorporation to effect the reverse stock split is attached to this Proxy Statement asAppendix A. The amendment will effect a reverse stock split of our common stock at a ratio that is not less than 1:3 nor greater than 1:7, with the final ratio to be selected by the Board in its discretion following stockholder approval. The Board, in its discretion, may elect to effect any one (but not more than one) of the reverse split ratios within that range upon receipt of stockholder approval, or none of them if the Board determines in its discretion not to proceed with the reverse stock split. We believe that the availability of alternative reverse split ratios will provide the Company with the flexibility to implement the reverse stock split in a manner designed to maximize the anticipated benefits for the Company and its stockholders. In determining which reverse stock split ratio to implement, if any, following the receipt of stockholder approval, the Board may consider, among other things, factors such as:

| 16 |

To avoid the existence of fractional shares of our common stock, stockholders who otherwise would be entitled to receive any fraction that results from the reverse stock split shall be entitled to receive cash (without interest or deduction) in lieu of such fractional interest in an amount equal to the product of (a) the fraction of one share owned by the stockholder following the reverse stock split multiplied by (b) the average closing sale price of the common stock on the NASDAQ Stock Market for the five trading days ending the last business day before the date the Certificate of Amendment is filed with Secretary of State of the State of Delaware.

As of March 24, 2016, the Company had approximately 12,922,535 shares of common stock issued and outstanding. Based on the number of shares of common stock currently issued and outstanding, immediately following the completion of the reverse stock split, and, for illustrative purposes only, assuming a 1:5 reverse stock split, we would have approximately 2,584,507 shares of common stock issued and outstanding (without giving effect to the treatment of fractional shares). The actual number of shares outstanding after giving effect to the reverse stock split will depend on the reverse split ratio that is ultimately selected by the Board. We do not expect the reverse stock split itself to have any economic effect on our stockholders, debt holders or holders of options or restricted stock.

There are no plans, arrangements or understandings of the Company or between the Company and any other person relating to the issuance of any newly authorized shares of stock if the reverse stock split is approved Ernst & Young LLPby stockholders and implemented by the Board under such authority.

Purpose of the reverse stock split

The Board authorized the reverse split of our common stock with the primary intent of increasing the price of our common stock in order to continue to meet NASDAQ’s price criteria for continued listing. Our common stock is publicly traded and listed on NASDAQ Global Select Market under the symbol “RELV.” The Board believes that, in addition to increasing the price of our common stock, the reverse stock split would also make our common stock more attractive to a broader range of institutional and other investors. Accordingly, for these and other reasons discussed below, we believe that effecting the reverse stock split is in the Company’s and its stockholders’ best interests.